How Do Credit Card Issuers Determine Credit Limits

Triston Martin

Dec 27, 2022

Preset Credit Limit Cards And Cards Without Predetermined Credit Limits

The amount of credit offered to cardholders by a card issuer is known as a credit card limit. When an application is accepted, a credit limit, also known as a credit line, is set depending on the customer's creditworthiness. With responsible card use, this amount may rise over time. Customers can also ask for gradual increases in their credit lines to better suit their needs. The majority of credit cards come with a predetermined credit limit. The issuer will then designate a specific dollar amount of outstanding balances you can have on your account in terms of new purchases and transferred balances once they have assessed your credit quality. If your credit scores allow it and the credit card issuer is ready to provide you with more credit, this predetermined limit may rise over time or at the client's request.

The amount of credit offered to cardholders by a card issuer is known as a credit card limit. When an application is accepted, a credit limit, also known as a credit line, is set depending on the customer's creditworthiness. With responsible card use, this amount may rise over time. Customers can also ask for gradual increases in their credit lines to better suit their needs. The majority of credit cards come with a predetermined credit limit. The issuer will then designate a specific dollar amount of outstanding balances you can have on your account in terms of new purchases and transferred balances once they have assessed your credit quality. If your credit scores allow it and the credit card issuer is ready to provide you with more credit, this predetermined limit may rise over time or at the client's request.

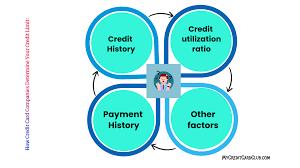

Credit Report and Other Factors

When determining your credit limit, most organization will evaluate your credit reports and your gross annual income level. Your history of making repayments, the length of your credit history, and the number of credit accounts shown on your report are all factors that issuers like to consider. Mortgages, school loans, car loans, personal loans, and other types of loans fall into this category. The quantity of credit report queries and negative marks, such as bankruptcies, collections, civil judgment, or tax liens, are also looked at by issuers. Your limit is funded appropriately by the corporation. If your credit scores allow it and the credit card issuer is ready to provide you with more credit, this predetermined limit may rise over time or at the client's request.

The underwriting procedure may be different depending on the company. Some issuers look at applicants' credit reports to determine the limits currently placed on their other credit cards. To determine how much to support the borrower, other agencies compare several ratings, such as the applicant's credit and bankruptcy scores. In determining how much of a danger an applicant is to them, issuers may also take into account the applicant's employment history or debt-to-income (DTI) ratio. If a person has a less extensive debt and a more believable employment history, they have a greater chance of enhancing their funding. If your credit scores allow it and the credit card issuer is ready to provide you with more credit, this predetermined limit may rise over time or at the client's request.

How Cardholders Can Request an Increase in Credit Limit

Suppose applicants have a track record of responsible usage and complete repayment of any amounts on or before the billing due date. In that case, this increases the likelihood of their credit being raised. Businesses often reevaluate every six months and, if necessary, automatically increase applicants' credit limits. Some issuers inform cardholders that they meet the requirements and inquire whether they wish to apply for higher credit limits. Cardholders can also ask for a raise by demonstrating their responsible usage history. On the other hand, if cardholders are late with payments or go above their credit card limitations, issuers frequently reduce the credit limit. By dialling the toll-free number on the back of your card or signing into your account online, you may find out your credit limit.

The Conclusion

A procedure known as underwriting, which varies from company to company but typically includes computing variables, including the applicant's credit score, history of credit card performance, and income level, is how credit card firms decide an applicant's credit limit. Cardholders can increase their credit limit by making on-time payments and staying within their credit limit. Experian PLC (EXPN.L) advises customers to increase their credit limit but only utilize a limited amount of it to improve their credit scores. Accessing various DeFi platforms, from crypto to NFTs and beyond, is easier than you imagine. You can trade and store assets with the help of OKX, a top provider of financial services for digital assets, and benefit from top-notch security. When you perform a deposit of more than $50 through a cryptocurrency purchase or top-up within 30 days of registration, you can connect existing wallets and win up to $10,000. Learn more and register right away.